Mapping software: the top 21 companies in the space

| Beauhurst

Category: Uncategorized

Einstein once said: “you can’t use an old map to explore a new world”. Cartography – and our understanding of location – is being amplified, enhanced and in some cases, replaced by technology. At the forefront of these developments are a series of innovative businesses working on everything from navigation, to analysis, and even creating completely new ways of seeing and understanding the world around us. We’ve seen over £120 million invested into such businesses since 2010, hitting a yearly high in 2018 of £44.6m.

The sector is complex, with businesses creating solutions in areas as diverse as location and mapping.

New addresses

It is difficult to find a company that better encapsulates mapping innovation than what3words. Founded in 2013 by Chris Sheldrick, the company has built an algorithm that divides the world into 3m x 3m squares, each assigned to a unique 3 word address. The idea of needing a new address system seems odd to a first-world western audience. But in large swathes of Africa and Asia, addresses can be inconsistent, and when combining the need for precise locations (for example, delivering high-value or critical goods or services), the need for a universal system becomes clear.

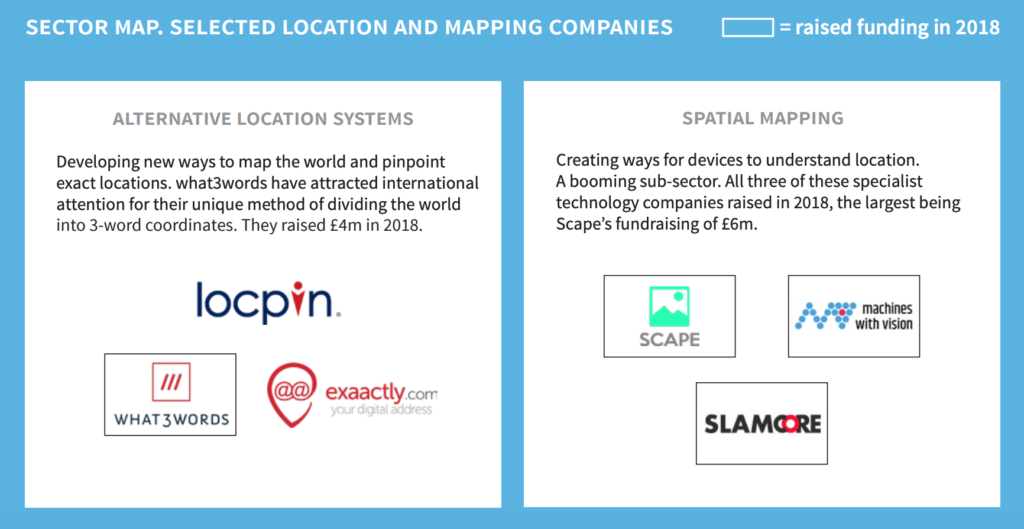

Alternative Location systems: Locpin, what3words, exaactly

Spatial mapping: Scape, Machines with vision, Slamcore

Investors certainly seem to agree. Since its founding in 2013, the young company has already reached growth stage, securing 10 rounds of funding from investors including Daimler, Intel Capital and, most recently, Sony. A £4m fundraising in June 2018 saw a pre-money valuation of £110m, and their latest deal, 7 months later, is highly likely to see a significantly higher valuation still. Why a corporate investor for this particular round? “I think that they can see the appeal of a product or service having some relation to what they do, and they can immediately create value and give you a leg up”, says Jack Waley-Cohen, Co-Founder and COO of what3words.

There’s also definitely a sense that big corporates are looking to do something with their cash at the moment, and in some cases are more prepared to invest in higher-risk businesses than traditional investors and some VCs.

John Waley-Cohen

And of course, there are other benefits beyond pure investment: “Having a big name on board also gives you great credibility, and has been extremely helpful to us, opening doors and giving introductions to other opportunities.”

What3words are only one example of the UK’s burgeoning mapping technology sector. Locpin, a seed-stage company in London are also seeking to map the world with 3m x 3m squares, numerically, rather than with words. Like what3words, they have benefited from strategic corporate venturing, participating in LMarks’ Drive with Belron accelerator, run by Belron (parent of Autoglass).

This programme seeks to find disruptive companies that help Belron improve their operations or products, with the ultimate aim of driving corporate innovation. Despite their early stage, the programme has allowed Locpin to sign a deal with Belron, meaning their technology is incorporated across the group’s companies to help them deliver services to precisely the right location.

New world, new maps

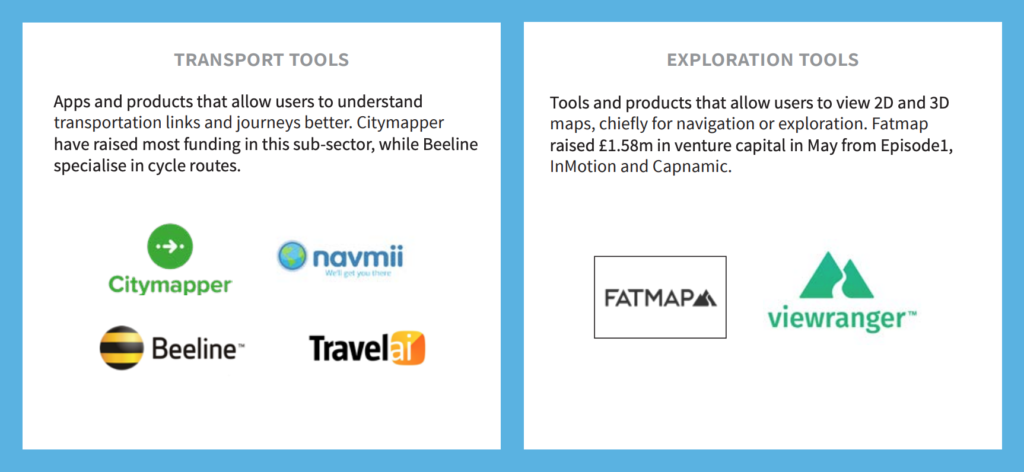

Google Maps reigns supreme as the most commonly-used mapping platform in the world, but other companies are looking to take advantage of smaller niches. London-based Fatmap provides detailed interactive 3D maps of outdoor spaces, particularly ski, walking and cycling routes, so adventurers and casual skiiers can preview routes before getting to a location. They raised £1.5m from Episode1, InMotion Ventures and Capnamic at a £11m premoney – a 21% higher valuation than their previous round in November 2017.

transport tools: citymapper, navmii, beeline, travelai

Exploration tools: Fatmap, Viewranger

When it comes to more standard navigation, particularly through urban environments, there are a host of high-growth British companies making waves. Citymapper is probably the best-known of this cohort, with the ambitious public transit app attracting almost £35m in investment from funders including Greylock Partners, Index Ventures and Balderton Capital. Travel AI have a similar proposition with their “Catch!” app, 39 Sectors making use of both equity investment from London Business Angels and over £700k of grants from Innovate UK.

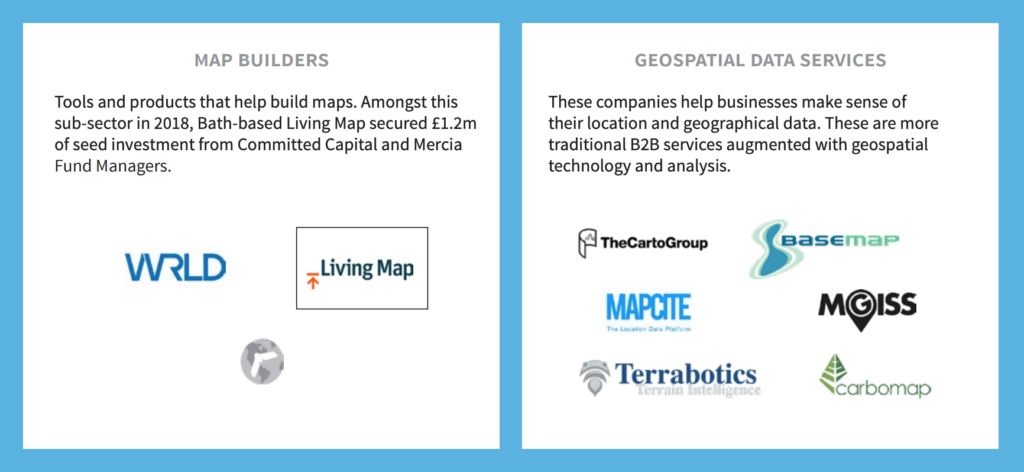

Geospatial data services: the carto group, basemap, mapcite, mgiss, terrabotics, carbomap

Map Builders: WRLD, Living Map, DroneLab

What does the future hold?

Location and mapping companies aren’t just looking at how to better serve the consumer, or indeed, humans. An increasing variety of British businesses are looking to build solutions to help autonomous vehicles, drones and other devices understand their location and position. This field, sometimes referred to as spatial learning or spatial intelligence, is growing quickly.

Scape is part of this movement, developing a “Vision Engine” for devices to understand their location based on 3D maps created from images. An Entrepreneur First alumnus, the Venture Stage company has raised over £12m from investors including Fly Ventures, LocalGlobe and Mosaic Ventures. Similarly, SLAMcore is developing its own spatial AI solutions. Since spinning out from Imperial College London in 2017, the Venture stage company has already raised £200k of Innovate UK grants and almost £5m in equity investment from a variety of funders including Toyota – another example of strategic corporate investment in innovative tech startups.

Fundamentally, location, and crucially, location data, is becoming an essential part of technical products in almost every conceivable industry. We predict that the number of new companies concentrating on mapping and location solutions will increase significantly over the next few years, and these will require ambitious backing from investors. Will more corporates see the potential and enter the ring, or will traditional VCs fill the gap? We haven’t yet mapped it out.

This story was first published in The Deal, a report analysing equity investment made into UK companies in 2018. Read the full report here.

Discover the UK's most innovative companies.

Get access to unrivalled data on all the businesses you need to know about, so you can approach the right leads, at the right time.

Book a 40 minute demo to see all the key features of the Beauhurst platform, plus the depth and breadth of data available.

An associate will work with you to build a sophisticated search, returning a dynamic list of organisations matching your ideal client.